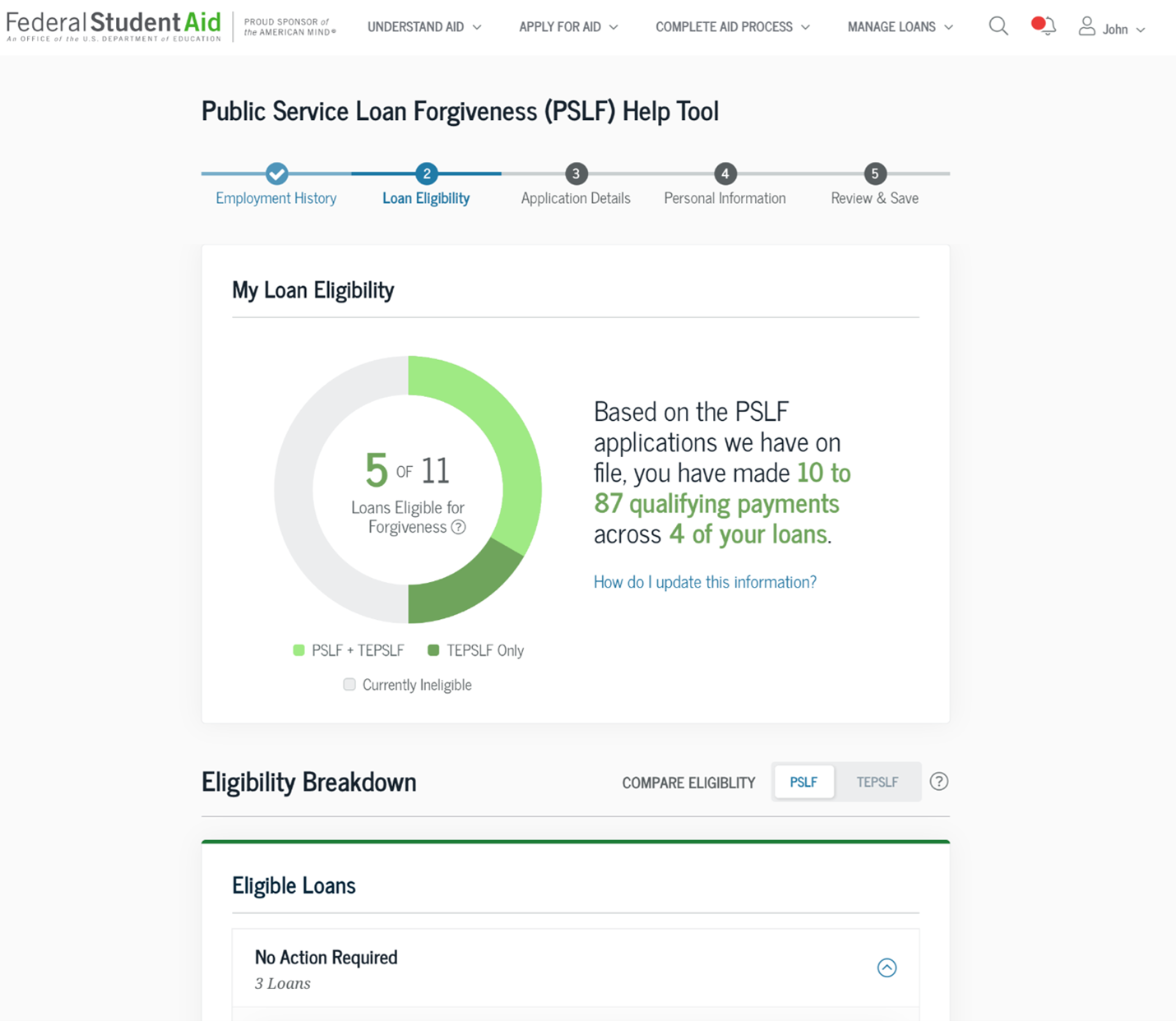

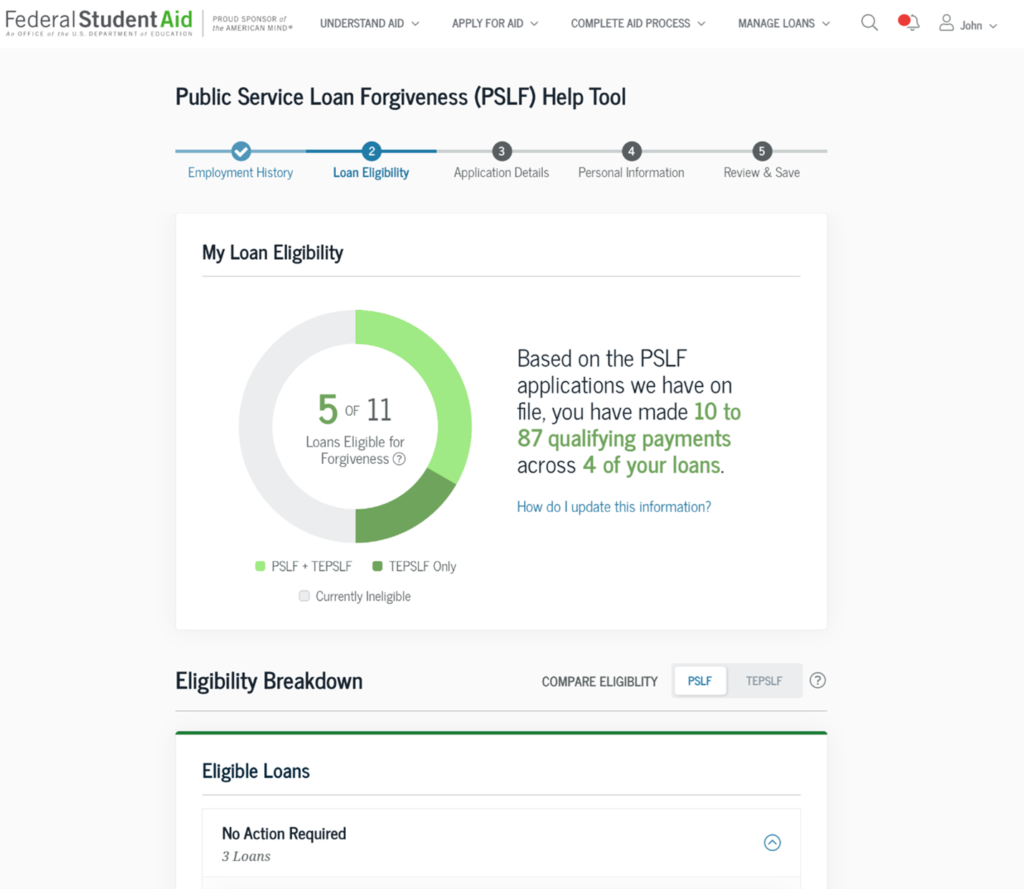

PSLF Loan Repayment – This PSLF form is one form that you need to complete to get the Public Service loan forgiveness program. The PSLF is an opportunity for you to get your loans repaid at the end of 10 years’ work. To be eligible for this program, you must work full-time for an eligible employer and be able to make 120 timely payments.

If you are not sure whether you are an employer that is qualified, here are some of the things which are considered to be qualifying:

-Your government employer

It is a 501(c)(3) non-profit organisation

A non-profit, public health care institution

-An AmeriCorps or Peace Corps volunteer service

When do I need to File For PSLF Loan Repayment?

You can qualify to apply for PSLF depending on whether you’ve got a loan that is eligible and you have made 120 qualifying payments on that loan. You may be able apply for PSLF after having made just 10 qualifying payments. However, the application must be filed during the first 10 years after the start of your repayment period.

There’s no need to apply for PSLF before the commencement of your loan period. You can wait until you’ve made 120 payment before you file for it.

Leave a Reply