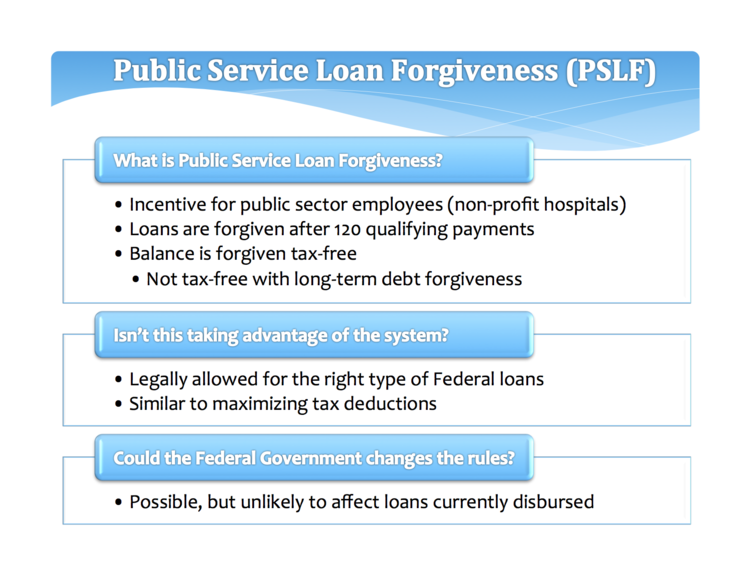

PSLF Tax Burden – The PSLF form is A form which you have to fill out in order to qualify for the Public Service Credit Forgiveness Plan. The PSLF is an opportunity for you to be granted loan forgiveness in the event of 10 years’ continuous service. The program is available to those who qualify. this program, you need to be employed full-time with a qualifying employer, and you must make on-time 120 payments.

If you are not sure about what is an employer that is qualified, here are some of the things that are eligible:

-Your government employer

The organization is 501(c)(3) non-profit organization

-A non-profit or public health care institution

-An AmeriCorps or Peace Corps volunteer service

What is the deadline to file for PSLF Tax Burden?

You’re eligible to apply to apply for PSLF in the event that you have a loan that is eligible and you have made 120 qualifying monthly payments on that loan. You may be able file for PSLF by making just 10 qualifying payment, but you must file for it within 10 years from the commencement of your repayment period.

You do not have to make an application for PSLF in the first month of the repayment period. You can wait until you’ve made 120 payments before filing for it.

Leave a Reply