PSLF Multiple Employers – It is the PSLF form is an form you must fill in to be eligible for the Public Service Invoice Forgiveness. The PSLF is an opportunity for you to receive your loans for free at the end of 10 years’ work. When you are eligible to join the program, you need to work full-time for a qualifying employer and pay 120 on-time payments.

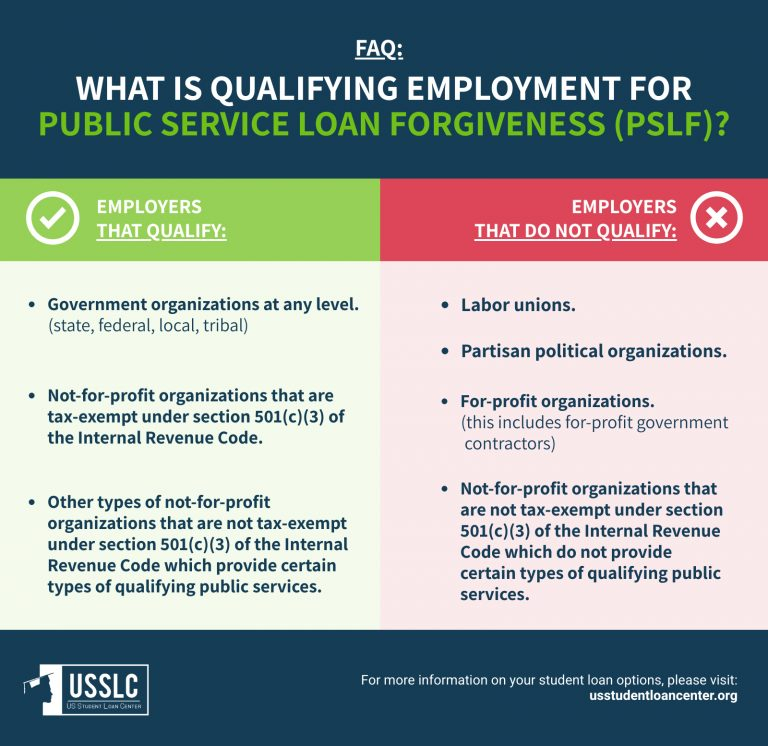

If you’re still not certain whether you are an eligible employer, there are a few things that count:

-Your government employer

The organization is 501(c)(3) non-profit organization

A public health organization

-An AmeriCorps or Peace Corps volunteer service

When do I have to File For PSLF Multiple Employers?

You can qualify to file for PSLF for those who have an eligible loan and have made 120 qualifying payments to that loan. You could be eligible to file for PSLF after only making 10 qualifying installments, but you must apply before the end of the repayment period.

It’s not necessary to declare PSLF from the very beginning of your repayment period. You may wait until you’ve made 120 payments before filing for it.

Leave a Reply