The Department of Education’s PSLF (Public Service Loan Forgiveness) Program requires you to fill out a PSLF Form to request a Limited PSLF Waiver for student borrowers. To qualify, your employer must certify that you work at least 30 hours a week. If you are a Peace Corps or AmeriCorps volunteer, your employer must certify that you are working at least 30 hours per week in order for you to receive a Limited PSLF Waiver.

Employer must certify that you are employed at least 30 hours per week to qualify

To qualify for the PSLF Form, you must be employed at least thirty hours per week with a 501(c)(3) nonprofit organization or a government agency. Most academic positions and residency programs satisfy this requirement. Your employer must certify that you are employed at least thirty hours per week with a qualifying organization. You cannot be employed by a private group.

For the PSLF, your employer must certify that you are employed at least thirty hours a week in order to qualify. Nonprofit organizations and government agencies are qualified employers for the PSLF program, but the government has very strict rules regarding these organizations. If you are employed full time, your employer must certify that you work at least 30 hours per week. For instance, employer-provided vacation time counts toward the number of hours per week.

If you are currently employed at a nonprofit, you may qualify for PSLF. In that case, you would have to look for other part-time jobs to qualify for PSLF. This doesn’t mean you have to drop your PSLF or work full-time to qualify for the PSLF Form. In fact, any paid position qualifies you automatically.

To qualify for the PSLF, you must be a full-time employee in qualifying employment for thirty hours a week. The amount of hours you work is not based on your annual average, but rather your average number of hours worked. If you have several part-time jobs, you may qualify if the combined average of these positions equals 30 hours a week.

While employers have discretion to certify your employment, it is advisable to apply for a Direct Loan after October 1, 2007. Consolidation will help you avoid being turned down and stranded without a loan. The deadline to file for PSLF is October 31, 2024. For those who have not yet received their Direct Loan, this is the time to take action. If you are unemployed at that time, it is a good idea to consolidate your loans into the Direct Loan Program and submit a PSLF Form.

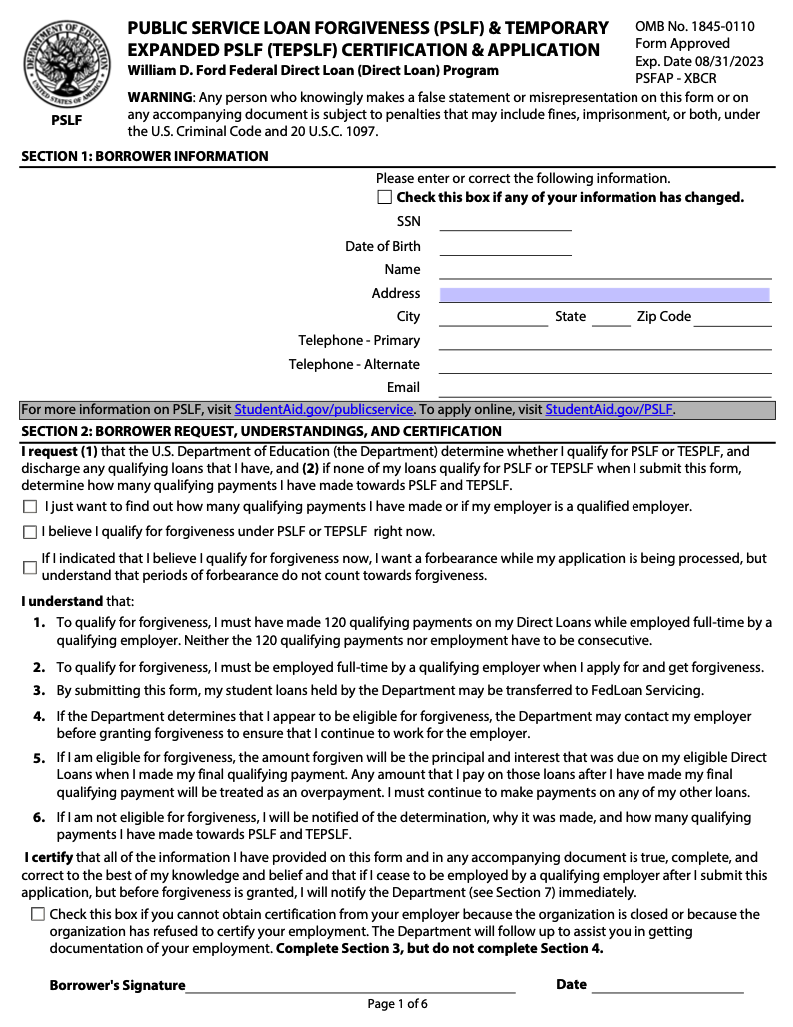

The PSLF form is the application and the PSLF Employer Certification Form for the benefits program. It certifies both the employer and the employee’s employment eligibility. It must be submitted when the employee first begins working at a qualifying employer and must be renewed at least once a year or when the employee changes employers. The form must be filled out carefully, and the employer must sign it to ensure the benefits are paid to all employees.

AmeriCorps and Peace Corps volunteers don’t qualify for PSLF

While the majority of Peace Corps and AmeriCorps volunteers don’t qualify for PSLF, some do. Depending on your circumstances, your peace corps service may qualify you to receive an income-driven payment plan, which allows you to make qualifying payments on your PSLF loans. PSLF eligibility is conditional on making certain payments over eight years. Peace Corps volunteers may use their transition payments to make qualifying payments, but you will need to keep these payments for at least eight years.

As a Peace Corps volunteer, you won’t qualify for PSLF, but the Peace Corps does offer an excellent student loan deferment plan. In fact, volunteers with federally-funded student loans are virtually guaranteed to be eligible for the Peace Corps Loan Deferment Program, which offers a minimum of three years of deferment benefits. However, this option does not apply to private student loans.

Many Peace Corps and AmeriCorps volunteers are surprised to learn they do not qualify for PSLF. However, there is hope! Since the program is income-driven, volunteers can defer payments until they can afford them. This is particularly beneficial for Peace Corps volunteers who earn a small stipend. But since the PSLF is based on income, volunteers can receive credit for their work in the Peace Corps while deferring payments.

The application process is relatively simple and streamlined. Applicants must meet certain eligibility requirements. For example, AmeriCorps volunteers can use their transition payment to make payments on their PSLF loans during their service terms. During the transition period, Peace Corps and AmeriCorps volunteers must use their PSLF transition payment to pay off their loans. Using the PSLF transition payment for education is particularly advantageous to Peace Corps and AmeriCorps volunteers who want to pay off their loans after their service ends.

For Peace Corps volunteers without Perkins loans, it is best to apply for loan deferment and use their Readjustment Allowance to pay off their student loan debt. While volunteering in the Peace Corps won’t make you rich, it will help you learn to be self-reliant and efficient. You can also get valuable work experience by volunteering abroad. So don’t let this opportunity pass you by!

Generally speaking, Peace Corps and AmeriCorps volunteers don’t qualify for PSLF. Both agencies offer incentives to return home after service. The Peace Corps awards more than $10,000. The Peace Corps offers more than $600. However, the Peace Corps awards a post-service cash allowance. Both programs have benefits that make it worthwhile to sign up. It’s also possible to apply for PSLF even after Peace Corps and AmeriCorps volunteers don’t qualify for PSLF.

AmeriCorps offers a variety of opportunities. Applicants should first create a profile with their personal information. Upon completing the profile, they can apply for open opportunities. Once they have chosen a program, they must decide how long they’ll serve. AmeriCorps has a step-by-step breakdown of the application process.

Limited PSLF Waiver for student borrowers

A new law that will affect the limited PSLF Waiver for student borrowers will stop any taxable interest on these loans. The American Rescue Plan Act will eliminate the tax on student loan income until 2026, and it applies to loans discharged in that time period. For borrowers who are still eligible for the limited PSLF waiver, it will mean a one-time account adjustment. Those who have made more than 12 consecutive months or 36 cumulative months of payments will be counted as qualifying for the program.

To qualify for the Limited PSLF Waiver for student borbors, you must be working for a qualifying employer and have been making payments for at least six months during the prior year. However, if you have had a period of deferment or forbearance in the past, you are not eligible for the waiver because these loans were not consolidated. If you are currently employed, you must move your federal student debt into a Direct Consolidation Loan by Oct. 31, 2024, or risk a denial.

The new rules for the Limited PSLF Waiver for student borbors are complex. Applicants must make additional payments, qualify for public service employment, enroll in a qualifying repayment plan, or be a public service employee for at least 10 years. However, borrowers may get credit for qualifying payments made in the past if they fulfill all requirements. So, this is a great opportunity for students to apply for the limited PSLF Waiver.

The Limited PSLF Waiver for student borbors has been around since the U.S. Department of Education announced it in 2014. However, you must act quickly to qualify. There is a deadline of October 31 for the program to expire. And you must apply by this date to avoid paying the loan again. You can also apply for the waiver through your federal loan servicer. This program is available to student borrowers who are working for a government agency or a 501(c)(3) organization.

For those whose student loans have reached the maximum amount of their eligibility, the Limited PSLF Waiver may be an option for you. This program has significant benefits for student borrowers and makes loan forgiveness easier for many people. But there are some changes to consider before applying. Listed below are some of the benefits of PSLF for student borrowers. When applied correctly, it can get you closer to loan forgiveness and freedom than you have ever dreamed of.

The PSLF waiver also provides relief for borrowers who had previously failed to pay their loans on time. Unfortunately, the limited PSLF for student borrowers does not apply to parent PLUS loans, which were issued before 2010. However, the IDR adjustment is not available for student borrowers who had taken out a private loan prior to July 2010.

Download PSLF Form